El seguro de accidentes de trabajo de PEO para proteger a su equipo sin preocupaciones

Proteja su empresa y a sus empleados con la cobertura workers compensation. Es esencial y legalmente obligatoria en la mayoría de los estados, garantizando la tranquilidad en sus operaciones diarias.

Dirigir una empresa conlleva bastantes retos, la cobertura de la indemnización de los trabajadores no debería ser una de ellas. En PEOPayGoAyudamos a las empresas de todos los tamaños a proteger a sus empleados con soluciones asequibles y de pago por uso que simplifican el cumplimiento, reducen los costes iniciales y mantienen seguro a su equipo.

Nuestra Programa de compensación de los trabajadores PEO le permite pagar sólo por lo que utiliza, sin depósitos, auditorías ni papeleo complejo. Desde pequeños propietarios con nóminas semanales hasta empresas en crecimiento con múltiples centros de trabajo, PEOPayGo ofrece una cobertura flexible adaptada a las necesidades empresariales del mundo real.

Asociarse con una PEO como PEOPayGo simplifica la gestión de la cobertura, integra los datos de las nóminas y reduce la carga administrativa al tiempo que garantiza el cumplimiento de la normativa.

¿Cómo funcionan las OPE de accidentes de trabajo?

PEOPayGo ofrece programas personalizados a empresas de todos los tamaños, sin las restricciones de las pólizas tradicionales. Desde pequeñas empresas con una nómina de $500 a la semana hasta grandes corporaciones con una elevada siniestralidad, nuestro Programa de pago por uso Workers Compensación es popular. Con nosotros, las empresas pueden pagar sólo por lo que utilizan, lo que hace que la gestión de RR.HH. y la indemnización de los trabajadores sean más asequibles y accesibles.

Proteja a sus empleados delo inesperado

La indemnización por accidente laboral le protege a usted y a sus empleados en caso de lesión o enfermedad laboral, y puede ayudarle a pagar:

Gastos médicos

Cubre los gastos médicos, garantizando que los empleados no tengan que soportar solos su carga financiera.

Lesión permanente

Proporciona a los trabajadores prestaciones vitales si sufren una lesión que les impide continuar su vida laboral.

Salarios perdidos

Permite a los empleados tomarse el tiempo necesario para una recuperación completa, dándoles la garantía de que pueden volver a su puesto de trabajo sintiéndose seguros y protegidos.

Responsabilidad de los empresarios

Proporciona una protección esencial a los empresarios, garantizando que puedan hacer frente a las responsabilidades relacionadas con las lesiones y enfermedades laborales.

Reentrenamiento

Proporciona un importante sistema de apoyo para ayudar a garantizar que los trabajadores desplazados estén equipados con las habilidades que necesitan para reincorporarse con éxito a la mano de obra.

Prestaciones de supervivencia

Ofrece un valioso salvavidas a las familias que se enfrentan a la tragedia de una pérdida inesperada.

PEO flexible workers comp

Sin auditorías, sin complicaciones, sin gastos de cancelación.

PEOPayGo ofrece el programa workers compensation más fácil y flexible. No hay molestias ni dolores de cabeza. Usted puede comenzar de inmediato y cambiar de opinión en cualquier momento.

¿Qué dicen nuestros clientes?

Nunca he tenido una experiencia mejor. Es increíble trabajar con Sasha Hernandez. Cuando tratas con ella, te sientes como si fueras su único cliente, conoce los entresijos de tu negocio sin ni siquiera mirar el ordenador. Yo recomendaría esta empresa sólo porque realmente la recomiendo a ella.

Estamos muy contentos de haber encontrado PEOPayGo. Desde que los hemos contratado, nuestra nómina y compensación de trabajadores ha sido mucho más fácil. Rose Gutierrez ha sido nuestro principal punto de contacto y siempre está disponible para nosotros y va más allá para ayudar.

Servicio impresionante, a prueba de idiotas. Te guían paso a paso y te explican y aclaran todo al máximo. Cada conversación es seguida por actualizaciones de texto y correos electrónicos. Gracias a Priscilla, Sandra, y Joanne para hacer todo sin problemas.

Nunca he tenido una experiencia mejor. Es increíble trabajar con Sasha Hernandez. Cuando tratas con ella, te sientes como si fueras su único cliente, conoce los entresijos de tu negocio sin ni siquiera mirar el ordenador. Yo recomendaría esta empresa sólo porque realmente la recomiendo a ella.

Servicio impresionante, a prueba de idiotas. Te guían paso a paso y te explican y aclaran todo al máximo. Cada conversación es seguida por actualizaciones de texto y correos electrónicos. Gracias a Priscilla, Sandra, y Joanne para hacer todo sin problemas.

Estamos muy contentos de haber encontrado PEO-Pay-Go. Desde que los hemos contratado, nuestra nómina y compensación de trabajadores ha sido mucho más fácil. Rose Gutierrez ha sido nuestro principal punto de contacto y siempre está disponible para nosotros y va más allá para ayudar.

PREGUNTAS FRECUENTES

La indemnización por accidente laboral es una póliza de seguro diseñada para proteger a empresarios y empleados de las pérdidas económicas debidas a accidentes laborales, fallecimientos u otros incidentes por una causa relacionada con el trabajo. Les ayuda a compensar algunos o todos los costes de tratamiento, demandas y otros daños.

Los empresarios pagan prestaciones de Indemnización por Accidentes de Trabajo para obtener la cobertura necesaria según la legislación de su estado, el tamaño de su empresa, el entorno de trabajo, los peligros, el número de empleados y otros factores pertinentes.

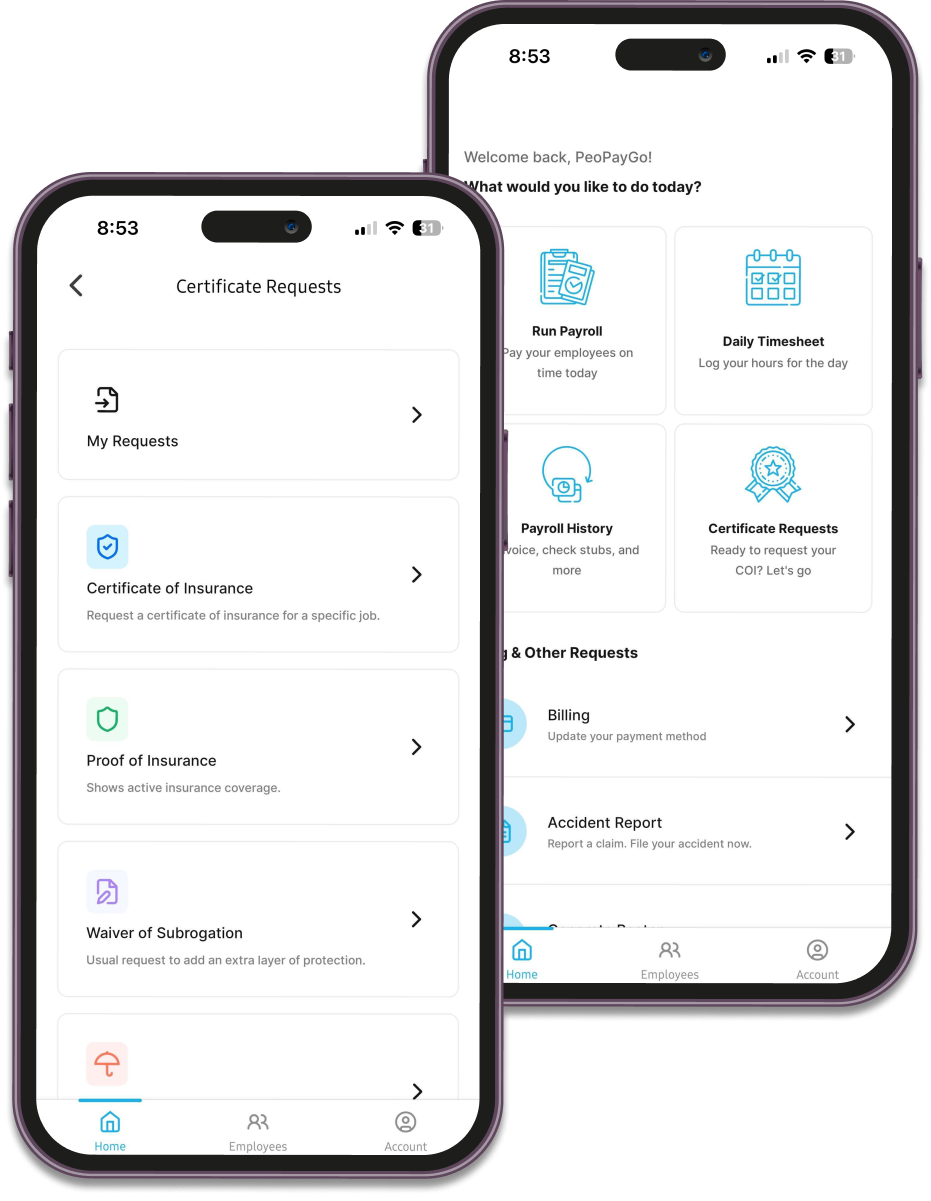

Para presentar una reclamación de indemnización por accidente laboral, tendrás que recopilar información, como la lesión o enfermedad sufrida por la víctima, los días de baja, los gastos médicos, etc. También tendrás que facilitar los datos de tu empresa, como el número de cuenta, la ubicación, el número de póliza, etc. Con una aplicación de indemnización por accidente laboral, puedes añadir de forma proactiva toda la información obligatoria y almacenarla siempre que sea necesario.

Casi todos los estados de EE.UU. obligan a las empresas a tener un seguro de indemnización por accidentes laborales, excepto los empresarios individuales, los profesionales autónomos y los contratistas independientes.

La gestión de la indemnización por accidente laboral basada en una aplicación ofrece una serie de ventajas a las empresas, desde una mayor visibilidad de los procesos de RRHH hasta informes en tiempo real y la tramitación automatizada de las reclamaciones, por nombrar algunas. Una aplicación de compensación laboral también mejora el cumplimiento de RRHH al digitalizar y centralizar toda la información y los procesos relevantes.