Florida startups face big responsibilities from day one, especially when it comes to payroll and workers’ comp. Running these separately creates more admin work, increases compliance risks, and strains cash flow. That’s why many new businesses are turning to workers’ comp and payroll services that combine both into one easy solution.

Bundling these services helps small employers meet Florida’s legal requirements while avoiding costly surprises. It also saves time and money, which are two things startups cannot afford to waste during their early growth phase or while building operations.

What Are Bundled Workers’ Comp and Payroll Services?

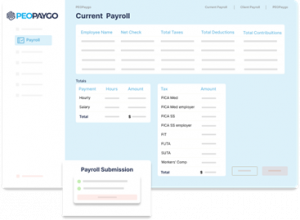

When a provider offers both payroll processing and workers’ comp coverage together, that’s a bundled service. Startups use it to manage responsibilities without juggling multiple vendors or systems, which can get complicated quickly.

In Florida, workers’ comp insurance for small businesses is required as soon as employees are hired. Coverage must be active, properly reported, and paid on time to avoid penalties or legal issues that may affect your business.

By bundling, startups can use pay-as-you-go workers’ comp. This system links workers’ comp premiums to actual payroll amounts. Instead of paying upfront, businesses pay as they go, based on real payroll data. This reduces overpayments and improves accuracy.

Benefits for Florida Startups

1. One Provider Means Less Admin

Working with one provider for both needs makes things simpler. Instead of managing two companies, everything runs through one system, saving time and reducing mistakes.

2. Better Cash Flow

With pay-as-you-go workers’ comp, startups avoid paying large premiums in advance. Payments are based on real-time payroll totals. This helps keep more money available for other business needs, such as marketing or product development.

3. Fewer Compliance Errors

Using separate systems for payroll and insurance increases the chance of errors. Bundling lowers the risk of missed tax filings or incorrect workers’ comp insurance for small business reports, which can result in unnecessary penalties.

4. Easier Reports and Audits

Bundled services keep payroll and insurance data in one place. This makes year-end audits and reports easier, faster, and more accurate. It also helps startups compare payroll and workers’ comp costs across different plans when budgeting.

Choosing the Right Partner

Startups need more than just software. They need full support. That’s where PEO services in Florida come in. A Professional Employer Organization (PEO) helps with payroll, HR, workers’ comp, and tax filings, all in one place.

Look for providers that include:

- Payroll tax filing and payment

- Employee onboarding and HR support

- Claims handling and safety services

- Clear payroll and workers’ comp cost breakdowns

- Options tailored to small business payroll services

Simplify Workers’ Comp and Payroll Today

Bundling these services helps Florida startups save money, stay compliant, and focus on long-term growth. With PEOPayGo, you get a pay-as-you-go solution tailored to your business needs and built for the Florida market.

Want to compare plans or ask questions? Contact us today for a free consultation and see how much easier payroll and workers’ comp can be with PEOPayGo.