Florida small businesses face rising labor costs, strict HR regulations, and growing employee benefit demands. A PEO for small businesses helps solve these challenges by managing HR tasks, lowering costs, and offering access to high-quality benefits. For small to mid-sized companies, this type of partnership makes staying competitive much more realistic.

By outsourcing HR operations, owners and managers can focus more on business growth and less on paperwork. A PEO allows small businesses to streamline their operations while staying compliant with Florida’s evolving employment laws.

What Is a PEO for Small Business?

A Professional Employer Organization (PEO) is a partner that manages core HR functions like payroll, benefits, workers’ comp, and compliance. It works under a co-employment model, where the PEO shares certain employer responsibilities while the business maintains full operational control.

When looking at PEO vs payroll company options, the distinction is clear. A payroll company typically handles only paychecks and tax filings. In contrast, a PEO offers full-service HR outsourcing, which includes employee benefits, compliance support, and risk management programs.

Key Advantages Florida SMBs Gain from a PEO

Reduced HR Workload and Admin Savings

One of the major benefits of PEO services is saving time and money. A PEO handles onboarding, timekeeping, payroll, and more, freeing your internal team for strategic work.

Access to Big-Business Employee Benefits

With employee benefits through PEO, small companies can offer healthcare, retirement, and other perks that help retain talent.

Better HR Compliance for Florida Rules

Small business HR compliance in Florida regulations is tough to manage alone. A PEO ensures wage laws, hiring policies, and reporting standards are always met.

Streamlined Payroll and Workers’ Comp

PEOs offer precise payroll services and pay-as-you-go workers’ comp programs that minimize audit risks and surprise costs.

Risk Reduction with Safety Programs

PEOs also offer workplace safety training, claims management, and risk assessments that can lower insurance premiums.

Evaluating Florida PEO Services: Features, Fit, and Cost Considerations

When selecting a provider, Florida business owners should look for essential features that reduce administrative burden and enhance employee experience. These include:

- Time tracking

- PTO systems

- Onboarding features

- Benefits administration

- Real HR guidance

Cost transparency is also critical. A reputable PEO will explain admin fees, per-employee pricing, and what drives your total monthly cost. Comparing plans based on these details helps you make an informed decision.

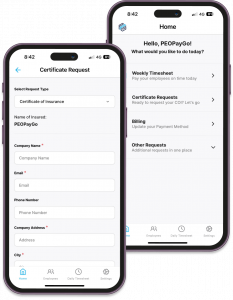

Many Florida SMBs choose PEOPayGo for our local expertise, flexible plans, and strong workers’ comp solutions. These features help ensure the right fit, no matter your company size or industry.

Why Choose PEOPayGo as Your Florida PEO Partner

Working with the right PEO service simplifies HR, reduces compliance risk, and delivers competitive benefits. At PEOPayGo, we combine local Florida knowledge with nationwide experience to support your business effectively.

Whether your goal is to cut HR costs, improve employee support, or manage compliance with confidence, we are ready to help. Contact us to learn how PEOPayGo can support your Florida business and help you stay competitive.