Managing tax and payroll compliance is one of the biggest challenges small and mid-sized businesses (SMBs) face. Constantly changing tax laws, strict filing deadlines, and classification rules create a complex system that most business owners struggle to keep up with. Payroll mistakes can lead to serious penalties, employee dissatisfaction, and unnecessary administrative stress.

That’s where HR and payroll outsourcing come in. By partnering with a PEO service, businesses gain expert support for managing tax filings, employee pay, and HR tasks, all while staying compliant with federal and state regulations. For SMBs looking for peace of mind and operational efficiency, outsourcing is often the smartest move.

Why Payroll and Compliance Are Major Pain Points

Most small and mid-size business owners don’t have a dedicated team to manage payroll tax filing and HR functions. From calculating withholdings to issuing year-end forms, each step comes with risks if done incorrectly. Common challenges include:

- -Misclassifying employees and independent contractors

- -Missing tax deadlines

- -Failing to track multistate tax requirements

- -Inaccurate benefit deductions

These issues make payroll tax filing services a major burden for SMBs. Without expert help, small teams often fall behind, opening themselves up to penalties and audits.

How PEO Payroll Services Streamline Operations

A PEO, or Professional Employer Organization, provides full-service HR and payroll outsourcing for businesses that want to grow without taking on the risks and workload of managing these tasks in-house. With PEO payroll services, companies gain access to:

- -Centralized payroll processing

- -Automated tax calculations and filings

- -Year-end tax documentation

- -Compliance tracking for all locations

- -Employee self-service platforms

This removes the guesswork from managing payroll and allows HR leaders to focus on strategic initiatives rather than paperwork.

Key Benefits of Using a PEO

The benefits of using a PEO go beyond just payroll. PEOs offer valuable HR support that helps companies manage small business HR compliance efficiently. These services include:

- -Up-to-date labor law guidance

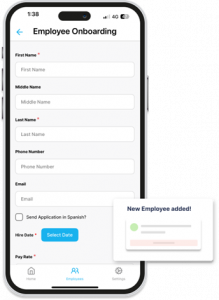

- -Professional support for onboarding and offboarding

- -Access to HR technology for tracking performance and time off

- -Improved employee experience through accurate, timely payroll

When you no longer have to worry about compliance errors or missed filings, your business can operate with more confidence.

Real-World Advantages for SMBs

SMBs that use PEO services report measurable improvements, including:

- -Reduced risk of penalties and audits

- -Fewer compliance-related issues

- -Time savings for internal teams

- -Better scalability across regions or departments

These results demonstrate why hr and payroll outsourcing is not just a cost-cutting tool but a strategic advantage for long-term growth.

Let PEOPayGo Handle Payroll and Compliance for You

Compliance doesn’t need to slow you down. With PEOPayGo’s expert PEO payroll services, you can streamline tax filings, reduce risk, and focus on what matters: growing your business without any hassle. Our team offers tailored payroll tax filing services and hands-on small business HR compliance support designed for companies just like yours.

Ready to simplify tax and payroll processes? Contact us today to discover the benefits of using a PEO through PEOPayGo.

As small and mid-sized companies expand, so do the challenges of managing HR tasks. Human resources teams must handle payroll, recruiting, compliance, benefits, and employee support, all while staying current with changing regulations. Without modern tools, HR operations become inefficient, prone to errors, and difficult to scale. This is where PEO services offer a powerful advantage, especially by providing access to advanced Human resources technology services and integrated technology.

A PEO (Professional Employer Organization) allows businesses to streamline HR functions using systems they might not otherwise afford or maintain internally. By offering tools like applicant tracking systems, HR automation software, human resources management systems, and employee benefits administration software, a PEO tool enables organizations to run smoothly and more effectively without a large HR department or IT infrastructure.

The Role of PEO Services in Modern HR

PEO services go beyond payroll processing. They form a co-employment relationship with your business and manage key HR functions such as compliance, benefits administration, and technology implementation. This relationship allows smaller companies to gain access to high-quality tools and support without hiring a full in-house HR team or relying only on a basic payroll provider.

Through these partnerships, businesses can optimize their workflows, reduce compliance risks, and enhance the overall employee experience.

Streamlining Recruitment with Applicant Tracking Systems

An applicant tracking system (ATS) simplifies the recruitment process by organizing job listings, tracking applicants, and supporting compliance with hiring laws. It also reduces manual paperwork, standardizes communication, and improves hiring speed and accuracy.

Instead of investing in an ATS independently, businesses that work with a PEO get access to this technology as part of their overall service package. This makes it easier to attract talent, stay compliant, and hire efficiently.

Efficiency with HR Automation Software and HR Management Systems

A human resources management system (HRMS) is a centralized platform where all employee data is stored securely. It integrates with HR automation software to handle repetitive tasks such as time tracking, onboarding, payroll, and performance management.

With automation, HR teams spend less time on manual tasks and more time on strategic goals. A PEO provides access to these tools and manages them on your behalf, ensuring everything works seamlessly and stays compliant with employment laws.

Simplifying Benefits with Employee Benefits Administration Software

Benefits administration is a complex area of HR. Employee benefits administration software simplifies enrollment, tracks eligibility, ensures legal compliance, and supports communication with employees.

By using a PEO, businesses avoid costly mistakes, reduce administrative load, and deliver a better experience to their employees. Everything from health insurance to retirement plans becomes easier to manage and track with us at PEOPayGo.

Take the Next Step Toward HR Efficiency

Integrating modern human resources technology through PEO services helps your business scale with confidence. With access to advanced tools, you can improve HR functions, reduce risks, and grow your team without adding stress.

Ready to see how PEOPayGo can simplify your HR operations? Contact us today to learn more about our services.

Managing remote and international teams introduces more than scheduling complications. From payroll regulations to employment laws, businesses face a maze of compliance rules that vary by country and even by state. When relying solely on a traditional payroll provider, many businesses risk non-compliance, payment errors, and employee dissatisfaction. These issues become more pronounced as teams grow across borders.

That’s where PEO services can make a major difference. A PEO acts as a full-service partner for your business, offering support with HR, payroll, benefits, and compliance. For companies expanding globally or managing remote employees, working with a PEO simplifies operations, reduces risks, and helps create a smoother experience for both managers and employees.

The Challenges of Global and Remote Teams

Expanding your business across regions or hiring remote workers can quickly overwhelm internal HR teams. Some common challenges include:

- Cross-Border Compliance Risks: Labor laws, tax regulations, and benefits requirements vary widely. Mistakes in any of these areas can result in fines or legal consequences.

- Payroll Complexity: A payroll provider may not have the infrastructure or knowledge to manage payroll in multiple jurisdictions effectively.

- Overburdened HR Teams: HR professionals are expected to manage everything from compliance updates to onboarding, but global expansion increases the workload significantly.

These challenges slow growth and create operational gaps if not handled strategically.

What Makes PEO Services the Right Fit

A PEO is more than just a payroll provider. It acts as a co-employer and shares responsibilities for managing employees. This relationship gives you access to expert HR outsourcing services that streamline international operations.

Key benefits of using a PEO include:

- -Hiring and onboarding employees in different regions

- -Managing tax and labor law compliance

- -Providing benefits administration and workers’ comp support

- -Centralized payroll processing with fewer errors

- -Access to trained HR professionals without hiring in-house

By working with a PEO, businesses gain time, reduce risks, and ensure employees are supported regardless of location.

How a PEO Supports Compliance and Payroll

PEOs take a proactive approach to help businesses remain compliant and organized. This is how:

Compliance and Payroll Advantages | What This Means for You |

Local Law Expertise | Stay compliant with country-specific regulations |

Consolidated Global Payroll | Avoid errors across currencies and tax systems |

Flexible Growth Support | Add team members anywhere without major overhead |

Expert HR Outsourcing Guidance | Eliminate guesswork in HR management |

This type of support is difficult to achieve when managing compliance or payroll alone or with just a payroll provider.

Your Next Step Toward Simpler Global Operations

Managing global and remote teams doesn’t have to be complicated. With the help of PEO services, businesses gain a reliable partner who handles payroll, HR, and compliance from start to finish. You don’t need to build an in-house HR department or juggle multiple service providers.

Let your business grow without the administrative burden holding you back with PEOPayGo. Ready to simplify compliance and payroll for your remote teams?

Contact our expert team at PEOPayGo today to learn more about our PEO services.