Understanding whether your PEO partnership is delivering real value comes down to data. Tracking PEO performance metrics gives businesses the clarity they need to make informed decisions, improve operations, and maximize return on investment. Business owners, HR professionals, and CFOs must track KPIs to evaluate success and continuously improve their HR strategy and outcomes.

Why Tracking PEO Performance Metrics Matters

PEOs offer various benefits from managing payroll and benefits to ensuring compliance but without tracking results, it’s difficult to measure success. Key metrics highlight where your outsourced HR solutions are driving efficiency and where improvements are needed. This visibility turns HR from a cost center into a performance-driven function.

Financial Metrics to Watch

One of the most critical indicators is PEO ROI. It answers the question: Are you getting your money’s worth from the services your PEO provides?

PEO ROI measures cost savings achieved through improved processes, reduced errors, and decreased legal risk. For example, automating payroll can reduce costly mistakes, while bundled benefits often lead to insurance savings.

Another important metric is the payroll accuracy rate. Mistakes in payroll damage employee trust and expose companies to compliance risks. A high payroll accuracy rate reflects the effectiveness of your PEO’s systems and processes.

HR and Employee-Focused KPIs

Your employee retention rate is another vital performance marker. A well-managed HR environment, with consistent onboarding, clear communication, and timely support, helps keep your team engaged and loyal. When retention improves after partnering with a PEO, it often signals that employee needs are being met more effectively.

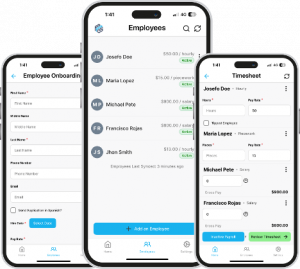

You should also monitor HR KPIs such as time-to-hire, onboarding completion rate, and employee satisfaction. These indicators help you evaluate how efficiently the PEO is managing your workforce processes and contributing to a positive employee experience.

Operational and Compliance Metrics

Beyond finances and retention, operational metrics reveal how well your PEO is managing complex tasks. This includes tracking automation rates in payroll processing, time saved through streamlined HR platforms, and error reduction in employee records.

Compliance performance is another must-track area. Look at missed deadlines, audit findings, or incorrect filings. PEOs should support regulatory accuracy, reduce your risk exposure, and help you stay ahead of employment law changes.

PEOPayGo’s Transparent Reporting and Insights

At PEOPayGo, clients benefit from real-time data dashboards and detailed reports that show exactly how their PEO services are performing. From payroll accuracy rate to employee retention trends, every insight is designed to help businesses operate smarter and more efficiently.

You’ll also receive expert analysis and guidance to interpret what the numbers mean, so you can make proactive, informed decisions that support long-term growth.

Start Measuring What Matters

If your business is investing in a PEO partnership, tracking the right metrics is the only way to measure success. From PEO performance metrics to HR KPIs, staying informed allows you to get the most from your partnership and continuously improve your operations.

See how PEOPayGo delivers measurable results. Contact us to explore our performance dashboard.

Diversity, equity, and inclusion (DEI) are no longer just buzzwords. They are core business priorities that drive innovation, employee satisfaction, and long-term growth. Businesses that embrace DEI are better positioned to attract top talent, improve retention, and enhance team performance.

However, turning DEI values into daily operations requires more than good intentions. That’s where PEO diversity and inclusion services can make a meaningful impact. By outsourcing HR functions to a professional employer organization (PEO), companies gain access to tools and expertise that help embed DEI principles into hiring, policies, and culture.

The Hidden Challenges of DEI Implementation

Many organizations struggle to implement effective workplace DEI programs due to limited resources, outdated technology, or unconscious bias. Manual HR processes can unintentionally reinforce inequality, while inconsistent documentation opens the door to legal risk.

Without guidance, internal HR teams may find it difficult to stay up to date with shifting laws and best practices related to HR compliance and DEI. This makes it hard to establish clear goals, track progress, or enforce fair policies across departments.

How PEOs Help Build Inclusive HR Systems

A PEO provides comprehensive HR services that create a strong foundation for DEI efforts. From the moment a candidate applies to the day they receive their final paycheck, a PEO helps ensure the process is structured, compliant, and inclusive.

Key areas of support include:

- Inclusive hiring practices that reduce bias in recruitment through structured workflows, anonymized resume screening, and standardized interview guides.

- Payroll systems that help monitor and enforce pay equity by providing clear data across roles, locations, and demographics.

- Centralized HR systems that help ensure fair access to promotions, benefits, and resources for all employees.

- Training modules and support to promote employee engagement and inclusion, covering topics like unconscious bias, inclusive leadership, and workplace respect.

Through these services, companies can focus less on administrative burden and more on building a culture where every team member feels seen, heard, and valued.

How PEOPayGo Champions DEI Success

At PEOPayGo, we believe that strong DEI practices begin with strong HR foundations. Our PEO model gives businesses access to expert-backed solutions that align with your inclusion goals.

We provide:

- DEI-focused policy development and documentation support

- Employee handbook customization for inclusive language and equitable practices

- Compliance tracking tools that monitor legal updates related to DEI at the federal and state levels

- Analytics that help measure the success of workplace DEI programs and identify areas for improvement

By supporting your internal team with modern, scalable HR infrastructure, PEOPayGo helps ensure your DEI initiatives are not only well-intentioned but also effective and sustainable.

Take the Next Step Toward a More Inclusive Future

DEI is not a one-time initiative. It is an ongoing commitment to fairness, equity, and representation in every aspect of your workplace. By partnering with a PEO like PEOPayGo, your business gains the tools and confidence to create long-term impact.

Build a stronger, more inclusive workplace. Contact us today to learn how PEOPayGo supports DEI-driven HR solutions.

Managing payroll across several states is one of the biggest challenges for growing companies. Each state has its own tax laws, wage regulations, and reporting deadlines, making maintaining multi-state payroll compliance complex and time-consuming. For businesses with remote employees or expanding operations, staying compliant can quickly become overwhelming without expert guidance and the right technology.

That’s why many companies turn to PEO payroll services. A professional employer organization (PEO) simplifies payroll, tax filings, and HR processes, helping your business remain compliant and efficient across multiple states. Instead of juggling dozens of rules and systems, a PEO gives you a single, reliable solution backed by experienced professionals.

Understanding Multi-State Payroll Challenges

When operating in more than one state, businesses must manage various tax rates, deduction requirements, and local labor laws. For example, one state may require state income tax withholding, while another might not. Some states mandate disability or family leave contributions, while others have unique minimum wage laws.

Without expert support, even small mistakes can lead to penalties or delayed filings. Manual processes and outdated systems increase the likelihood of payroll tax errors, especially when handling remote employee payroll across multiple locations. The result is wasted time, unnecessary stress, and potential damage to employee trust and company credibility.

How a PEO Simplifies Payroll Compliance

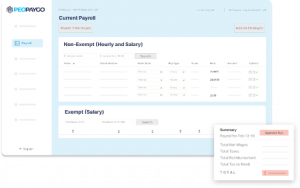

A PEO integrates payroll, HR, and benefits into one streamlined platform, ensuring accuracy and consistency. With multi-state payroll compliance as a focus, PEOs handle tax filings, reporting, and employee classification automatically for better control and reliability.

Here’s how a PEO simplifies the process:

- Automated payroll tax compliance to meet state-specific filing requirements

- Accurate employee classification across multiple states to avoid misfiling

- Centralized systems that connect payroll with HR data for improved accuracy

- Consistent remote employee payroll regardless of where staff are based

This integration ensures compliance while reducing the administrative workload for your internal HR team.

Benefits of PEOPayGo’s Multi-State Expertise

Partnering with PEOPayGo means gaining a team that specializes in HR compliance across states. Their technology-driven approach helps prevent common mistakes before they happen and saves time.

Key benefits include:

- Real-time compliance monitoring and updates on new regulations

- Automated tax filings for each jurisdiction

- Expert guidance from HR and payroll professionals

- Cost and time savings through automation and centralized systems

- Improved accuracy and reporting across all state operations

By consolidating your payroll and HR processes, your employees get paid accurately and on time while helping your business avoid unnecessary fines or compliance issues.

Simplify Payroll and Compliance with Confidence

Running a business across multiple states does not have to mean constant payroll stress or confusion. A PEO partnership brings expertise, automation, and accuracy to your operations. With help from PEOPayGo, you can manage taxes, wages, and compliance more efficiently while focusing on what matters most: growing your business and supporting your team.

Ready to simplify your multi-state payroll? Contact us today to discover how PEOPayGo’s PEO payroll services can streamline your compliance.