Managing payroll across several states is one of the biggest challenges for growing companies. Each state has its own tax laws, wage regulations, and reporting deadlines, making maintaining multi-state payroll compliance complex and time-consuming. For businesses with remote employees or expanding operations, staying compliant can quickly become overwhelming without expert guidance and the right technology.

That’s why many companies turn to PEO payroll services. A professional employer organization (PEO) simplifies payroll, tax filings, and HR processes, helping your business remain compliant and efficient across multiple states. Instead of juggling dozens of rules and systems, a PEO gives you a single, reliable solution backed by experienced professionals.

Understanding Multi-State Payroll Challenges

When operating in more than one state, businesses must manage various tax rates, deduction requirements, and local labor laws. For example, one state may require state income tax withholding, while another might not. Some states mandate disability or family leave contributions, while others have unique minimum wage laws.

Without expert support, even small mistakes can lead to penalties or delayed filings. Manual processes and outdated systems increase the likelihood of payroll tax errors, especially when handling remote employee payroll across multiple locations. The result is wasted time, unnecessary stress, and potential damage to employee trust and company credibility.

How a PEO Simplifies Payroll Compliance

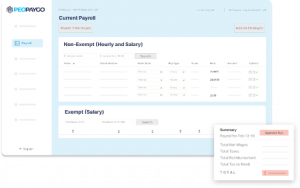

A PEO integrates payroll, HR, and benefits into one streamlined platform, ensuring accuracy and consistency. With multi-state payroll compliance as a focus, PEOs handle tax filings, reporting, and employee classification automatically for better control and reliability.

Here’s how a PEO simplifies the process:

- Automated payroll tax compliance to meet state-specific filing requirements

- Accurate employee classification across multiple states to avoid misfiling

- Centralized systems that connect payroll with HR data for improved accuracy

- Consistent remote employee payroll regardless of where staff are based

This integration ensures compliance while reducing the administrative workload for your internal HR team.

Benefits of PEOPayGo’s Multi-State Expertise

Partnering with PEOPayGo means gaining a team that specializes in HR compliance across states. Their technology-driven approach helps prevent common mistakes before they happen and saves time.

Key benefits include:

- Real-time compliance monitoring and updates on new regulations

- Automated tax filings for each jurisdiction

- Expert guidance from HR and payroll professionals

- Cost and time savings through automation and centralized systems

- Improved accuracy and reporting across all state operations

By consolidating your payroll and HR processes, your employees get paid accurately and on time while helping your business avoid unnecessary fines or compliance issues.

Simplify Payroll and Compliance with Confidence

Running a business across multiple states does not have to mean constant payroll stress or confusion. A PEO partnership brings expertise, automation, and accuracy to your operations. With help from PEOPayGo, you can manage taxes, wages, and compliance more efficiently while focusing on what matters most: growing your business and supporting your team.

Ready to simplify your multi-state payroll? Contact us today to discover how PEOPayGo’s PEO payroll services can streamline your compliance.