Simplify complex tasks

quickly & easily.

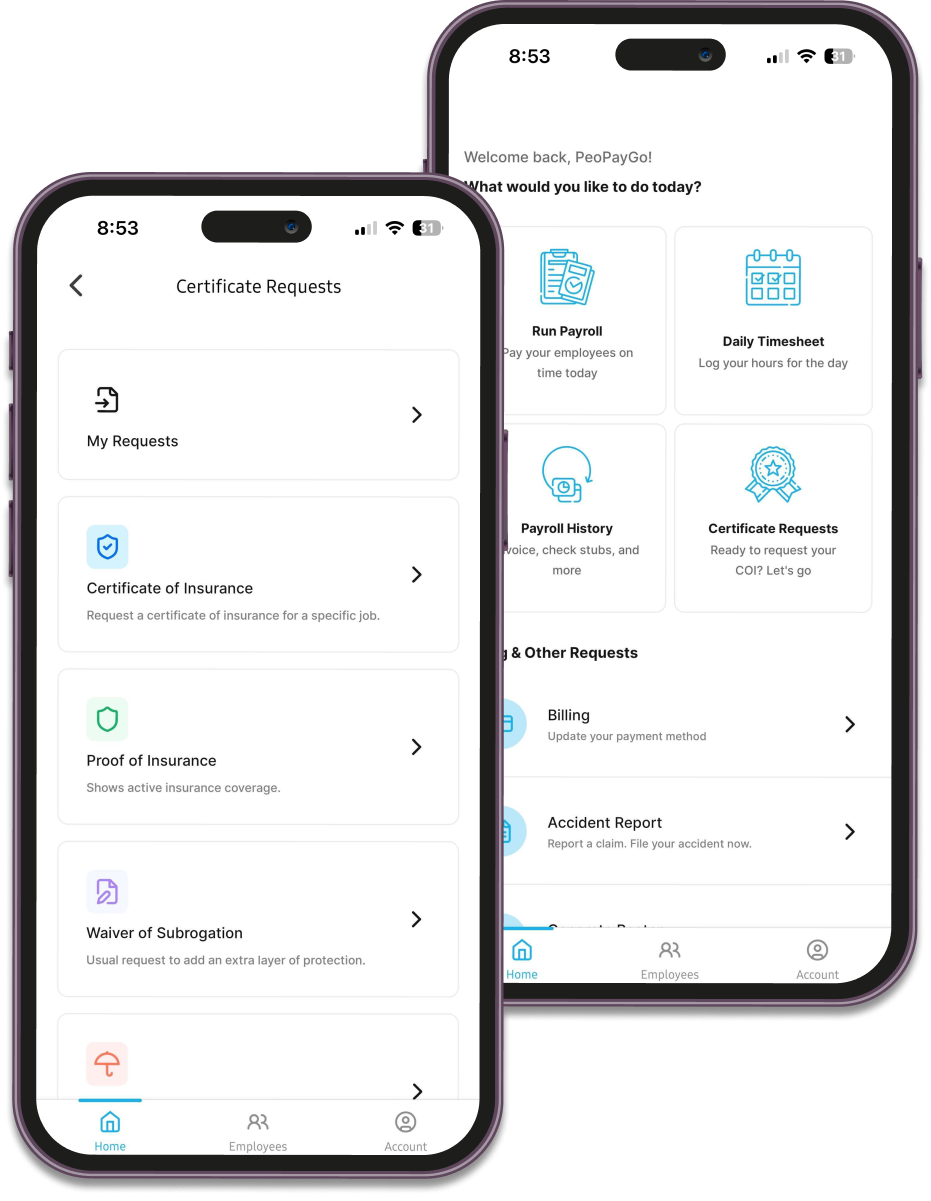

Hassle-free workers comp solutions

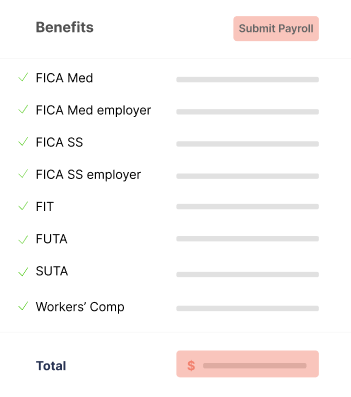

Choose pay-as-you-go workers’ compensation insurance for hassle-free coverage. Once you run payroll, employees are automatically insured. To get a certificate of insurance, fill out the online form, and the carrier will process it instantly. Expect same-day certificates 95% of the time.

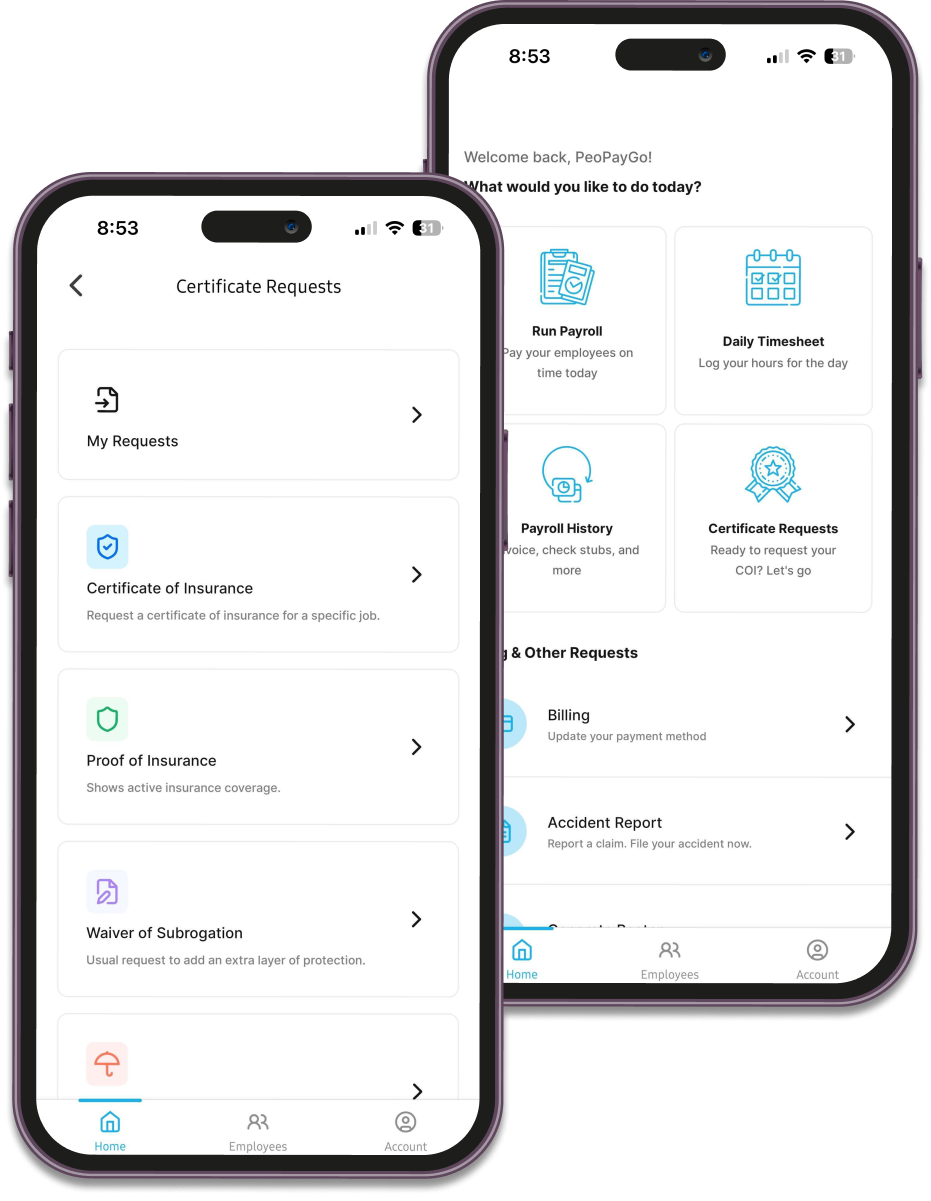

Full-service payroll platform

- Run payroll on your own or

- Have payroll run automatically every week or

- Have our team of payroll experts run payroll for you.

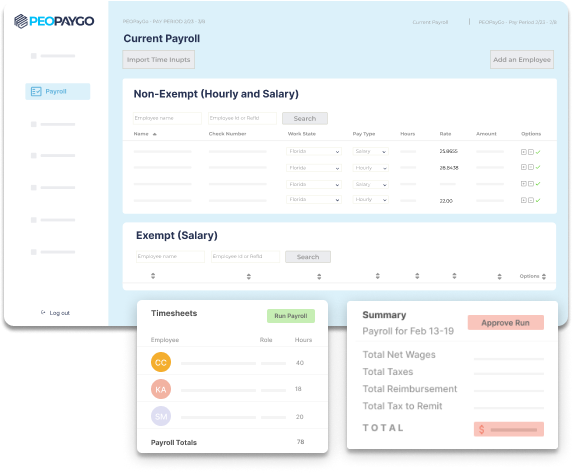

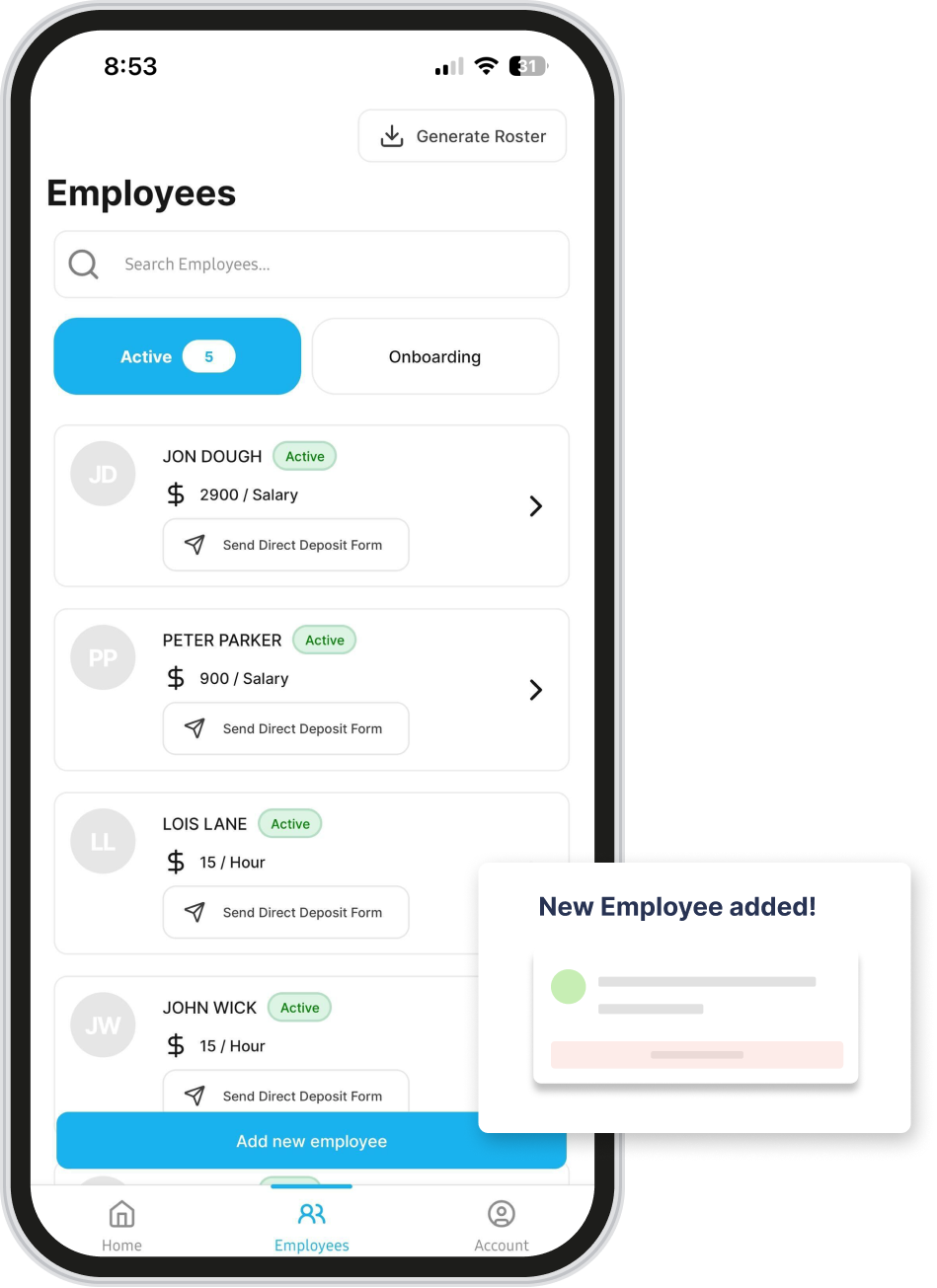

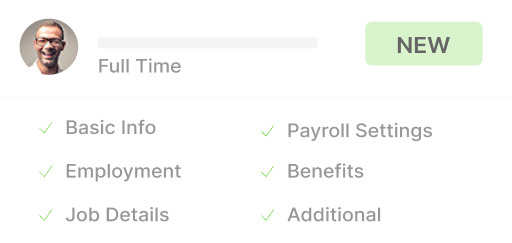

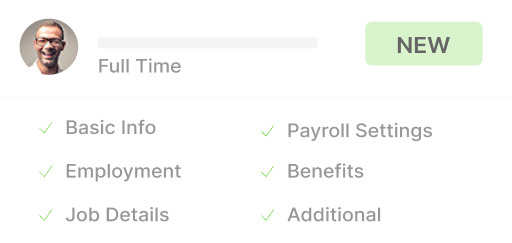

Simplified onboarding

To enroll your employees, simply enter their name, pay rate, phone number, email, and job title, and click submit. Thanks to our mobile-friendly onboarding platform, your employees can join your company quickly and easily by following the instructions they receive in a text message.

HR services made simple

Our team of experts offer solutions to simplify and streamline your daily operations. With us on the job, you can dedicate more time to enhancing the development of your business. W2/1099 will be available at the end of the year to employees via email or mail.

Pay-as-you-go workers' compensation:

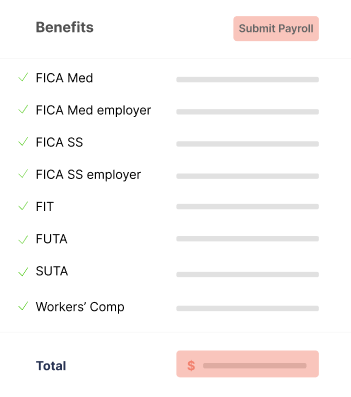

When employing staff, you need to cover their wages, payroll taxes (such as FICA taxes and unemployment taxes), Workers’ Comp, and administrative costs, which are all included in your invoice when you report hours to us. In all states except Texas, workers’ compensation is required by law.

Employers and employees enjoy fully self-serve onboarding and management tools.

Experience

We offer expert support to your employees with personalized attention and tools.

Excellence

Hire, manage, and pay your employees knowing every check is correct.

Compliance

Never miss another employer tax filing again. We’ve got your back.

Employers pay for Worker’s Compensation benefits to provide the necessary coverage per their state’s laws, business size, workplace environment, hazards, number of employees, and other relevant factors.

A payroll service is a third-party company offering experts, tools, and/or software solutions that assist with payroll processing and simplify essential functions, such as employee tracking, worker’s compensation, tax management, financial reporting, and information storage/access.

Payroll software solutions suit startups and small businesses looking to digitalize their HR operations. They store employee information and offer different features that simplify operations, such as automatic calculations, deductions, and payments. Meanwhile, payroll services are more expensive as they involve hiring third-party experts to take over the payroll management function.

Nearly every US state requires businesses to carry Worker’s Compensation insurance, except sole proprietors, self-employed professionals, and independent contractors.

A typical payroll software solution enables users to calculate and deposit employee wages after tax and other deductions. Modern solutions like GOATPayroll offer several other features, such as third-party integrations, HR compliance, workers’ comp claim management, etc.

Our software does all the work for you.