Streamline your payroll: embrace a new era of efficiency.

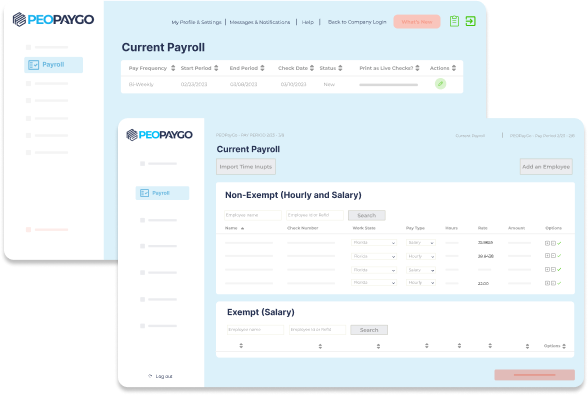

Managing payroll shouldn’t feel like a full-time job. With PEOPayGo, you can automate payroll processing, eliminate manual errors, and streamline HR and workers’ compensation tasks, all from one powerful, easy-to-use platform.

Our all-in-one payroll solution helps small and mid-sized businesses pay employees accurately, stay compliant with tax laws, and manage workforce data effortlessly, so you can focus on growth, not paperwork.

Join hundreds of businesses nationwide that trust PEOPayGo to simplify payroll and workers’ comp.

Stressed about payroll? simplify it with ease!

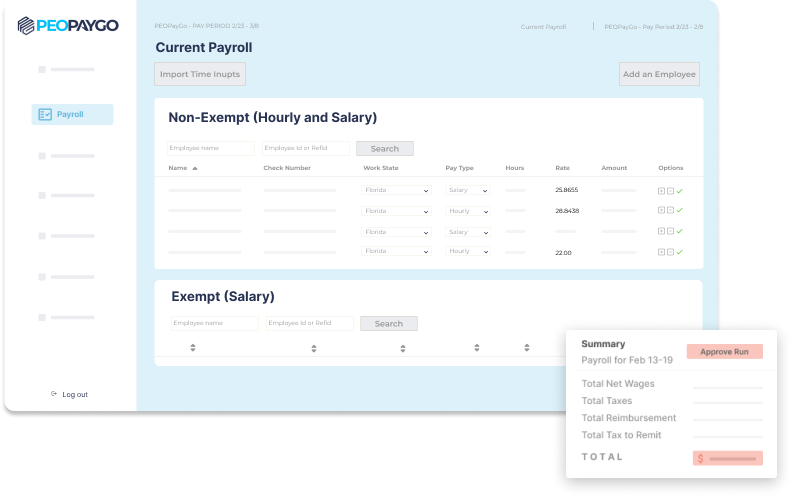

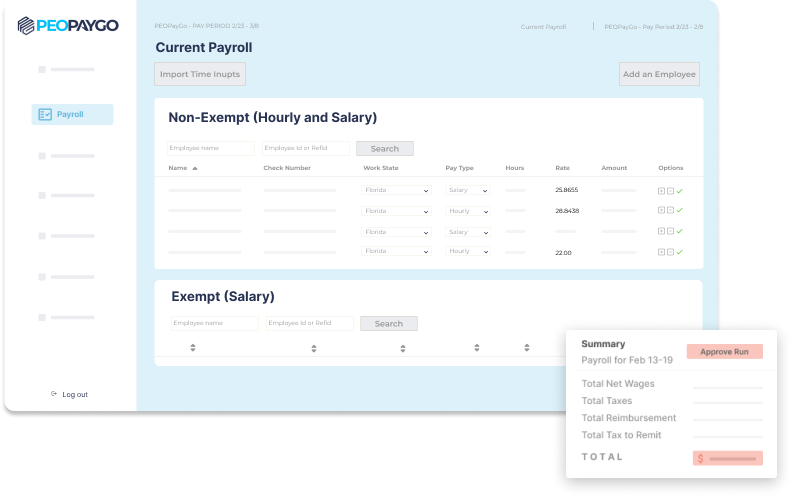

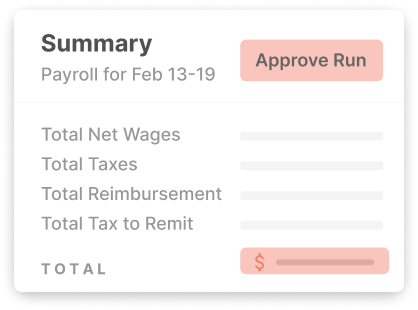

You can rely on hassle-free payments through direct deposits as we handle all your tax calculations and filing with just a few clicks.

- Employee self-onboarding

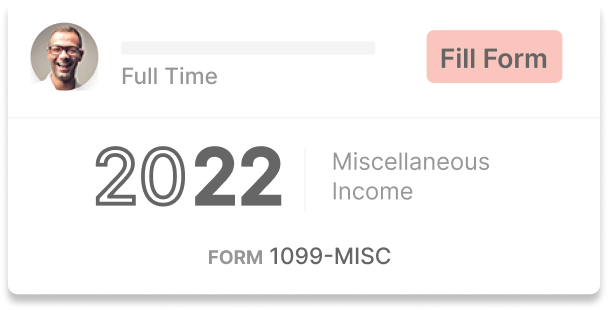

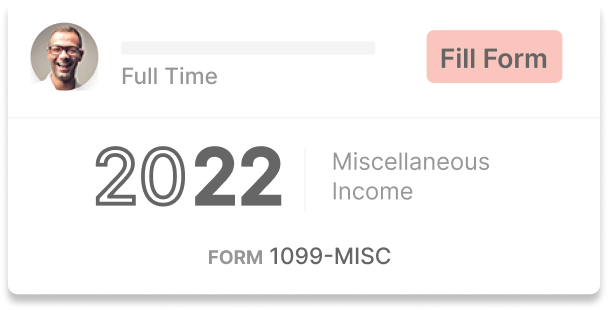

Your employees can easily fill out their payroll forms by themselves, without you needing to input any sensitive tax or bank details.

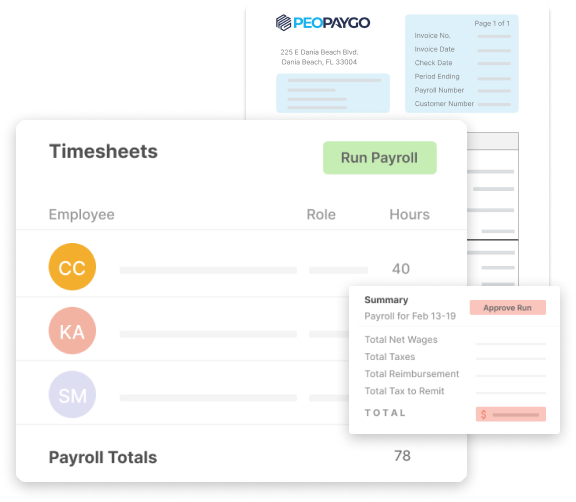

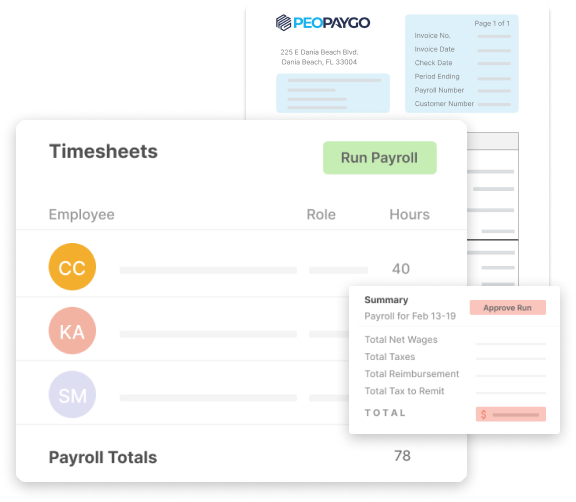

Instantly convert your timesheets into hours and wages in payroll.

Your new hire reporting is submitted automatically, and we also file and distribute W-2s and 1099s on your behalf.

Ensure your employees receive payment conveniently through direct deposit or printable checks.

Joining your company is now as easy as sending a text, thanks to our user-friendly mobile onboarding platform.

Quick setup payroll platform

Payroll compliance

Taxes & Filing

Get unlimited access to our team

I’ve never had a better experience. Sasha Hernandez is amazing to work with. When dealing with her, you feel like you are her only client, she knows the ins and outs of your business without even looking at the computer. I would recommend this company only because I truly recommend her.

We’re very happy to have found PEOPayGo. Since we have hired them, our payroll and workers comp has been much easier. Rose Gutierrez has been our main point of contact and she’s always available for us and goes above and beyond to help.

Awesome service, idiot-proof. They walk you through everything step by step with everything spelled out and clarified to the max. Every conversation is followed by text updates and emails. Thanks to Priscilla, Sandra, and Joanne for making everything smooth.

I’ve never had a better experience. Sasha Hernandez is amazing to work with. When dealing with her, you feel like you are her only client, she knows the ins and outs of your business without even looking at the computer. I would recommend this company only because I truly recommend her.

Awesome service, idiot-proof. They walk you through everything step by step with everything spelled out and clarified to the max. Every conversation is followed by text updates and emails. Thanks to Priscilla, Sandra, and Joanne for making everything smooth.

We’re very happy to have found PEO-Pay-Go. Since we have hired them, our payroll and workers comp has been much easier. Rose Gutierrez has been our main point of contact and she’s always available for us and goes above and beyond to help.

Payroll is the process of calculating employee pay and making any tax or benefit deductions before processing their payments.

An automated payroll system has several benefits, including increased accuracy, efficiency, and cost-effectiveness. With PeoPayGo’s automated payroll system, businesses can avoid errors and delays that come with manual processing. Our system automates tax calculations, filings, and other payroll-related tasks, saving time and money for our clients. Additionally, our platform provides real-time access to payroll data and reports, enabling businesses to make informed decisions and stay in compliance with all applicable laws and regulations. Overall, an automated payroll system simplifies payroll processing and streamlines operations for businesses of all sizes.

Payroll is one of the most important aspects of HR operations. It affects employees’ financial stability as they rely on their paychecks to fund different expenses.

Payroll deductions are withheld wages from total employee earnings used to pay for taxes, insurance premiums, and other benefits.

The taxes that need to be paid with every payroll run to maintain compliance with state regulations vary depending on the state. However, common taxes that businesses must pay with each payroll run include federal income tax, Social Security tax, and Medicare tax. Additionally, some states require businesses to pay state income tax and unemployment tax. It is essential to stay up to date with your state’s tax laws and regulations to ensure that you are compliant and avoid penalties. At PeoPayGo, we help our clients manage payroll taxes and stay in compliance with all applicable laws and regulations.

Our software does all the work for you.